Country and Sector Risk Barometer Q3 2023: Macroeconomics put to the test by microeconomic deterioration

The good news at the start of 2023 quickly gave way to hints that the end of the year would be far less promising.

Over and above the financial stability, social, and political risks that have already been discussed, some of which continue to intensify, we should bear in mind that the fight against inflation has not yet been won. Excluding energy, inflation remains well above the targets set by central banks, while the situation with the oil market has again become tense following the attacks in Israel.

All the leading indicators point to a sharp slowdown in activity in North America and the Eurozone toward the end of the year, while the recovery of the Chinese economy has rapidly collided with structural weaknesses and a lack of confidence among households and businesses.

In this context, we have modified seven country risk assessments (two upgrades and five downgrades) and 33 sector risk assessments (17 upgrades and 16 downgrades), reflecting a degree of stability in our expectations over the next 18 months in an environment that remains highly volatile and uncertain.

Towards a multipolar world

In recent months, several events have shaken up the geopolitical landscape, adding to the ongoing and increasingly intense Sino-American rivalry. One of these developments is the expansion of the Brazil, Russia, India, China, and South Africa (BRICS) group. BRICS has grown to include six new members: Saudi Arabia, Argentina, Egypt, the UAE, Ethiopia, and Iran, causing some analysts to speculate this expansion could signal a significant shift away from the dominance of the G7 and, by extension, the post-war world order.

However, the BRICS+ group’s capacity to present an alternative vision and take concrete steps to compete with the G7 is likely to remain limited, primarily due to non-aligned objectives among its members and ongoing tensions between China and India.

Inflation eases but is not overcome

As anticipated in our previous barometers, inflation has continued to recede “mechanically” in recent months, largely a result of energy and commodity prices dropping below the peaks reached shortly after the invasion of Ukraine. Goods disinflation, linked to the rebalancing of demand toward the consumption of services and the return to normalcy of supply chains, is also ongoing. The signs that inflation is well entrenched remain, and core inflation has been declining much slower in advanced economies. Furthermore, the risks we previously highlighted concerning the resurgence of inflationary pressures toward the end of the year appear to be materializing. This is evident as oil prices have been steadily rising since the start of the summer season.

The rhetoric that followed the pause in rate hikes by the European Central Bank, the Fed, and the Bank of England suggested that while the tightening cycle may have ended no rate cuts are expected in the coming months or quarters.

Disappointing - and already over - recovery in China

China’s post-Covid recovery has been underwhelming, with economic data for both domestic demand and exports coming in soft. Cautious households have caused the widely expected rebound in consumption to be relatively weak. In fact, the abandonment of the zero-Covid policy and the subsequent reopening of the Chinese economy only managed to provide an uneven boost to consumption patterns.

Investment has also been less of a growth driver for China, as the private sector has remained cautious toward fixed capital expenditures, notably due to real estate market, which continues to be concerning.

Appeasement for energy and agri-food in Europe

The changes in sector risk assessments this quarter were mostly in Europe, particularly in the energy, agri-food, and paper sectors. We are upgrading the energy sector in all Western European countries excluding Germany, mainly because of higher margins for hydrocarbon producers and refiners. The agri-food sector in the region is also enjoying more positive momentum, unlike the paper sector, which is recording the highest number of downgrades.

Mounting social and political risk is confirmed

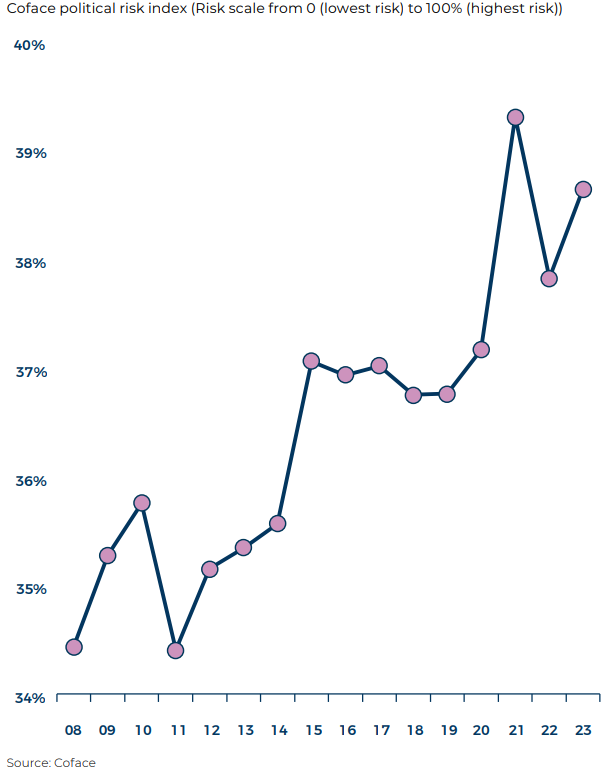

Following Russia's invasion of Ukraine last year, Coface warned of the possibility of increased social risks due to rising prices for energy, basic goods, and foodstuffs. When we updated our political risk indicator for 2022, we reiterated this warning. In this 2023 edition of the political risk indicator, our concerns are growing, with the erosion of people's living conditions leading to new sources of frustration.

In recent years, political risk in its various forms and countries, such as Sri Lanka, Argentina, Niger, and Gabon, has been a recurring theme in the news. The same is true for advanced economies such as Israel, the United Kingdom, and the United States. Social and political risk seems to be on the rise in a world that is becoming increasingly uncertain and unstable because of the shifting global playing field and the perceptible climate change emergency.

Regarding security, there was an increase in the number of conflicts in 2022, resulting in a notably high death toll. While certain conflicts have de-escalated, as seen in the cases of Afghanistan and Yemen, others have either newly emerged or intensified. For instance, in September, the situation in Nagorno-Karabakh underscored the persistent border crisis between Armenia and Azerbaijan.

In Africa, the number of active state and non-state conflicts has almost tripled since 2010. This trend is particularly linked to the fight against jihadist groups operating in Burkina Faso, Mali, Niger, Chad, and Nigeria, for example. This aggravated security context in the Sahel, and the difficulties in containing the Islamist insurgency since 2020, has also played a role in the recent political upheavals in the region. After coups d’état in Mali and Chad in 2021 and twice in Burkina Faso in 2022, Niger experienced its own this summer.