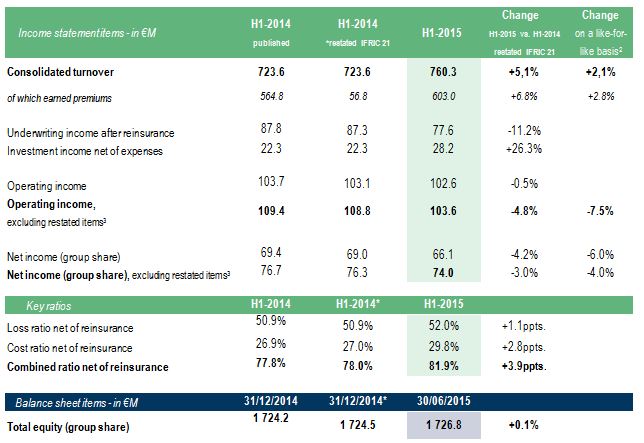

H1-2015 results: Coface posts a profit of EUR 66 million in spite of an increase in claims in emerging countries

- Growth in turnover: + 5.1% at current scope and exchange rates (+ 2.1% at constant scope and exchange rates)

- Combined ratio after reinsurance impacted by the increase in claims’ frequency at 81.9% (up 3.9 percentage points compared with H1-2014 and up 0.5 percentage point compared with H2-2014)

- Good quality net income (Group share), at €66M (vs. €69M in H1-2014 and €56M in H2-2014)

- Agreement in principle concluded today with the French government on the transfer of the public guarantees activity in France[1] valuated at approximately €90M

Unless otherwise stated, changes are in comparison with results at 30 June 2014

Published results for 2014 have been restated to take into account the impact of IFRIC 21

Jean-Marc Pillu, CEO of the Coface Group, commented:

"Since the end of last year, at the occasion of our periodic results publications, we have noted weaknesses affecting the macro-economic environment. The first half of this year confirms this trend, and it was marked by an increase in the frequency of claims, in particular in emerging markets.

Given this context, we are publishing good quality half-year results. The Group thus confirms the robustness of its business model: product innovation and multi-channel distribution, while controlling risks and costs.”

Commenting on the agreement in principle concluded on the transfer of the French State public guarantees activity, he added:

“Otherwise, the uncertainty which weighed on the future of our public guarantees activity is now lifted and the financial terms of the transfer have been agreed. Coface aims to limit its impact on the Group’s results and is currently studying the implementation of an operational efficiency programme.”

Key figures as at 30 June 2015

The board of directors of Coface SA examined the consolidated financial statements for the first half years 2015 during its meeting on July 28th 2015. They were subject to a limited examination by the Statutory Auditors.

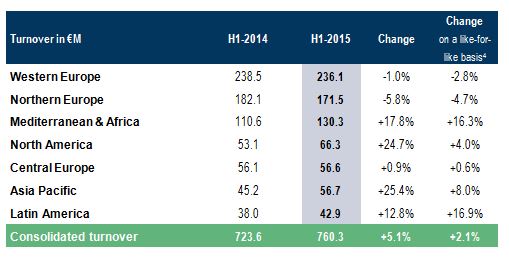

1. TURNOVER

In the first half of 2015, Coface registered a turnover of €760.3M, up 5.1% compared with the first half of 2014 (up 2.1% at constant scope and exchange rates).

This evolution demonstrates the appropriateness of the commercial strategy implemented by the Group since 2013, based on a policy of product innovation and multi-channel distribution, and is accompanied by enhanced monitoring and sales processes.

The process of overhauling and specializing the range by market segment was marked during this half year by the launch of TradeLiner, Coface's flagship offer designed to meet the needs of medium sized companies.

Meanwhile Coface's footprint in emerging markets continues to be an advantage and the Group is pursuing the expansion of its geographic positioning in order to consolidate its ability to capture growth. To this end, Coface obtained a licence to act as insurer in Israel (January 2015) and opened a new sales office in Kazakhstan (in January 2015).

The increase in the Group's turnover continues to be driven by emerging markets and North America: in these areas, the new commercial approach is producing results.

In more mature markets, particularly in Western Europe and Northern Europe, where competition is stiff and weights on prices, the deployment of Coface's new commercial strategy involves deep structural changes. Their effects will only materialize over time.

2. RESULTS

- Combined ratio

Over the first half of 2015, the combined ratio after reinsurance was particularly impacted by the increase in claims and stands at 81.9%, increasing 3.9 percentage points compared with the first half of 2014 and rising 0.5 percentage points from the second half of 2014.

The emergence of weaknesses, especially in Russia, China, Latin America as well as in certain business sectors has led since the second half of 2014 to an increase in the claims level. This resulted in deterioration of the loss ratio net of reinsurance of 1.1 percentage point compared with the first half of 2014 at 52.0%.

The cost ratio net of reinsurance was 29.8%, up 2.8 percentage points compared with the first half of 2014. This increase is explained by distribution costs, due in particular to turnover growth in regions where contracts are commercialized through brokers or partners.

Internal overheads[5] are under control: at constant scope and exchange rates, their progression by 1.2% in the half-year (up 2.8% at current scope and exchange rates) is less than that of premiums, respectively at 2.8% (up 6.8% at current scope and exchange rates).

- Financial income

At the end of the past half year, financial income[6] amounted to €28.2M against €22.3M in the same period in 2014. In a favorable context in the equity market, Coface externalized €7.6M of capital gains on the first half 2015 against €3M in the same period in 2014.

- Operating income and net income

Excluding restated items, operating income was €103.6M and the net income (group share) was €74.0M[7].

3. FINANCIAL SOLIDITY

IFRS equity Coface SA group share was €1,720M at June 30, 2015, compared to €1,718M at the end of December 2014.

The change in equity is mainly due to the impact of net income for the period of €66.1M and the distribution of €75.5M to shareholders.

On July 17th, Fitch Ratings agency confirmed the financial solidity rating (IFS) AA- it attributes to the Coface Group, with a stable outlook. The agency also upgraded by a notch its issuer default rating (IDR) for Coface SA to A +, also with a stable outlook.

4. TRANSFER OF FRENCH STATE PUBLIC GUARANTEES ACTIVITY [8]

The French government announced in February 2015 that it was examining the possibility of transferring the French State public guarantees activity, currently carried out by Coface, to the Bpifrance group. Having studied and discussed the project with Coface, the French government announced today, July 29th, its decision to implement the project, in line with its aim to consolidate under one establishment the support it offers to SME and larger companies.

Coface and the French government have agreed the financial terms of such a transfer[8]. These consist of a principle of payment of €77.2M, corresponding to a valuation of approximately €89.7M before tax, net of estimated liabilities of €12.5M as at end-December 2014.

The transfer[8] is scheduled to take place in the course of 2016. It will take the form of a cession to Bpifrance of the standalone State public guarantees activity, composed of teams and dedicated systems (IT, contracts,…), as well as corresponding assets and liabilities.

This payment[9] will allow Coface to absorb immediate depreciation charges[9] (estimated at €17.3M before tax) and contribute to absorbing the loss of the margin (€11.7M) and remaining fixed costs (€20.8M) at Coface’s charge (amounts estimated on a full-year basis).

The loss of this activity will mechanically lead to a 1.4 percentage point decrease in RoATE (on a full-year basis). Coface intends to limit these effects and is studying the implementation of an operational efficiency programme.

5. OUTLOOK

The rise in claims recorded during the first-half confirms that the global growth, recovering at a slow pace, remains fragile and entails risks. Emerging economies - among the largest - are experiencing structural difficulties and suffering from the weakening of their growth model.

In this context, Coface will remain vigilant and will continue to be proactive and selective in its risk monitoring to secure its profitability and that of its clients..

Published results for 2014 have been restated to take into account the impact of IFRIC 21

[1]: This transfer will be subject to a modification of the legislative and regulatory framework applicable to State public guarantees activity.

[2]: At constant scope and exchange rates.

[3]: Operating income and net income (Group share) includes financing costs (€4.8M for H1-2014 and €10.2M for H1-2015) and are restated to exclude the following items: interest charges for the hybrid debt (€-4.0,M), charges linked to the initial public offering (€-7.0M), operating expenses related to the restructuring of SBCE (€-1.0M), restructuring income (€1.5M) and other expenses (€-0.1M) at June 30th, 2014; interest charges for the hybrid debt (€-8.1M), operational expenses linked to the restructuring of the distribution network in the United States and other expenses (€-3.2M) - see note 19 of the financial statements in the half-year 2015 financial report at June 30th, 2015. For the calculation of net income a normalised tax rate has been applied to these elements for H1-2014 and H1-2015 respectively.

[4]: At constant scope and exchange rates.

[5]: Internal overheads are restated to exclude expenses related to Coface Re costs, including staff, location and others (€0.4m) for H1-2015.

[6]: Investments net of expenses, excluding cost of debt.

[7]: Operating income and net income (Group share) includes financing costs (€4.8M for H1-2014 and €10.2M for H1-2015) and are restated to exclude the following items: interest charges for the hybrid debt (€-4.0,M), charges linked to the initial public offering (€-7.0M), operating expenses related to the restructuring of SBCE (€-1.0M), restructuring income (€1.5M) and other expenses (€-0.1M) at June 30th, 2014; interest charges for the hybrid debt (€-8.1M), operational expenses linked to the restructuring of the distribution network in the United States and other expenses (€-3.2M) - see note 19 of the financial statements in the half-year 2015 financial report at June 30th, 2015. For the calculation of net income a normalised tax rate has been applied to these elements for H1-2014 and H1-2015 respectively.

[8] This transfer will be subject to a modification of the legislative and regulatory framework applicable to State public guarantees activity.

[9] The valuation of €89.7M before tax and depreciation charges will be registered in our financial statements once the legislative and regulatory framework applicable to State public guarantees activity will be modified.

Contact

Annie Lorenzana

COMMUNICATIONS MANAGER

North America

MOB: +1 (407) 221-3496

Annie.Lorenzana@coface.com