Coface Panorama on Sub-Saharan Africa:Three East African Economies Are Sheltered from the Economic Storm

Global credit insurer Coface recently reviewed the economic situation in 45 African countries, finding 13 growing economies despite the fall in world commodity prices, and three economies that have the ingredients needed for dynamic growth in both the short and long-term.

Thirteen Countries Relatively Unaffected by the Decline in World Commodity Prices

An exceptional combination of positive factors has helped accelerate growth in Africa, at a rate of about 5% per year on average since 2008. These factors include structural adjustment linked to the relatively low per capita income, high foreign investment, a more stable political environment and numerous debt cancellations. The upturn was also boosted by the high prices of commodities on which the region is highly dependent. Fuels (mainly oil) account for 53% of sub-Saharan export sales, well ahead of ores, metals and gemstones (17%) and food products and agricultural commodities (11%). For some countries, such as Nigeria, Chad, Equatorial Guinea and Angola, the proportion of fuels within export sales is 60% to 100%.

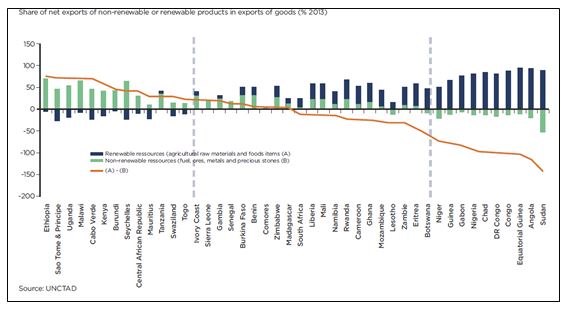

The region has been weakened by the magnitude and longevity of the fall in commodity prices. The situation varies between countries, depending on whether they are net exporters of non-renewable resources (crude oil and base metals in free fall) or net exporters of renewable resources (food and agricultural commodities, for which the fall in prices is limited). Of the 45 countries reviewed (see Appendix), Coface has identified 13 relatively unaffected countries: Ethiopia, Sao Tome, Uganda, Malawi, Cape Verde, Kenya, Burundi, Seychelles, Central African Republic, Mauritius, Tanzania, Swaziland, and Togo. In these countries, the fall in export prices is less than that of their imported products.

The Biggest Winners: Kenya, Ethiopia,and Uganda

To take the review of long-term risks a step further, Coface economists also looked at economic diversification, which reduces vulnerability, supports long-term growth and enhances resilience to external impacts. Only three countries have a satisfactory degree of economic diversification, without being penalized in the short term by lower commodity prices. These are Ethiopia, Uganda and Kenya. Recent figures confirm their potential for dynamic growth, with the growth in GDP reaching nearly 7% on average in 2014, comparable to that of China.

- In Ethiopia and Uganda, diversification is achieved through the manufacturing sector, where growth is linked to successful integration into global value chains (similar to some South-East Asian countries). Over one hundred products are exported, a number that more than tripled between 2000 and 2013. Two sectors in particular, textiles and the processing of agricultural produce, are contributing to the diversification of the economy.Rwanda, which also meets the diversification criterion, is affected by fluctuations in commodity prices, so it is not among the "winners."

- Kenya has opted for a development model based on services, which account for over 60% of its GDP. Unlike other sub-Saharan African economies that traditionally focus on trade, transport/storage activities and public services, Kenya is showing positive gains in telecommunications/mobile banking and the outsourcing of business services as a result of cheap labor.

"However, this positive observation and the region’s undeniable potential do not mean the total absence of risk. Political stability in the region is fragile. The lack of infrastructure is also a known vulnerability, as are the high current account deficit and increasing public debt levels," warned Julien Marcilly, Chief Economist of Coface.

Contact

Annie Lorenzana

COMMUNICATIONS MANAGER

North America

MOB: +1 (407) 221-3496

Annie.Lorenzana@coface.com