Coface Country Risk Update: Improvement in Western Europe and the "New" Emerging Economies

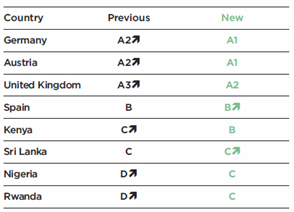

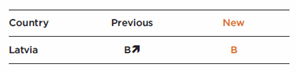

In its latest country risk Panorama, global credit insurer Coface forecasts the acceleration in global growth to 3% in 2014 and 3.3% in 2015, up from 2.6% in 2013. As a result, Coface has upgraded the country risk assessments of Germany, Austria, United Kingdom, Spain, Kenya, Sri Lanka, Nigeria and Rwanda. In the only negative action, the positive watch on Latvia’s rating was removed.

Click here for the full Panorama.

In addition to the assessment updates, the Panorama features an in-depth article on the recovery in the United Kingdom and provides updates to the Coface Country Risk Handbook for several countries, including Brazil, France, Germany, India, Italyand Russia.

Germany, Austria, UK and Spain: Improvement Based on Increasing Investment

It has taken five years for Germany and Austria to return to the top risk category of A1, alongside the US, Japan and Switzerland. Germany has confirmed its role as Europe's engine, with remarkably balanced growth (estimated at 2% in 2014, after 0.5% in 2013). Consumption in Germany, historically sluggish, is lively, and investment has started again. Business confidence is high, supported by a drop in the number (-8% over one year) and cost (-30%) of insolvencies. In Austria,companies are cash rich and are benefiting from the low cost of credit as well as the recoveries in Germany, Eastern Europe and the US. Despite the insolvency of Alpine Bau in 2013, company insolvencies in the country have been falling for several months.

The UK has been upgraded to A2, with growth there forecasted at 2.7% in 2014. The upturn in consumption reflects the drop in unemployment. British growth is now healthier, with strong corporate investment expected to be a key driver of economic activity in 2014 and 2015. In addition, the Bank of England has taken measures to limit the frenzy over real estate and to support access to credit for small businesses. Finally, British industry is showing signs of renewal, demonstrated by the export success of the pharmaceutical, automotive, aeronautics and defense industries.

A further positive change is seen in Spain, which was hit hard by the crisis. Spain’s B assessment has been placed on positive watch. The Spanish recovery is accelerating, with growth of 1.2% forecast for 2014 and 1.7% for 2015. Exports are growing, particularly to emerging markets, helped by reduced labor costs. Despite the private sector’s high debt, corporate deleveraging is underway. Company margins have been re-established (45% in 2013) and cash flow is good (above 100%).

Latvia: Hit by the Situation in Russia and the Ukraine

Coface has removed Latvia(B) from the positive watchlist. Geopolitical tensions around Ukraine are likely to affect the confidence of Eastern European business and the country suffers the dependence on Russia for its gas supplies.

Kenya, Rwanda, Nigeria and Sri Lanka: High Potential

Growth will remain high in emerging countries, forecast at 4.4% in 2014 and 4.7% in 2015. These economies are benefiting from expanding middle classes and are taking advantage of the improved growth prospects in advanced economies, particularly through exports.

Despite an often difficult business environment, growth potential is particularly high in several African and Asian countries. Coface has upgraded the country assessments of Kenya(B), Nigeria(C) and Rwanda(C). Sri Lanka is also seeing strong growth (estimated at 7% in 2014 and 6.5% in 2015) driven by consumption based on a sharp increase in revenue and transfers from expatriates.

Sri Lanka and Kenya are among 10 emerging countries that Coface has detected as promising “new BRICs.”

Appendix

Coface Country Risk Assessments measure the average risk of non-payment by companies in the context of their short-term commercial transactions. In creating the assessments, Coface brings together the economic, political and financial outlooks for the country, Coface’s payment experience and the business environment of the country. Sovereign debt is not included.

The assessments are based on a seven-level scale: A1, A2, A3, A4, B, C, and D, which can be combined with positive and negative watch categories.

Assessments either upgraded or removed from negative watch list or placed on positive watch list

Assessments either downgraded or removed from positive watch list or placed on negative watch list

Contact

Annie Lorenzana

COMMUNICATIONS MANAGER

North America

MOB: +1 (407) 221-3496

Annie.Lorenzana@coface.com