Coface Corporate Payment Survey: Brazil Payment Experience Affected by the Bleak Economic Situation

Coface’s first Brazil payment survey, conducted with over 120 companies, reveals a challenging environment, even though the country is expected to exit recession in 2017 with a meager growth rate of 0.4%.

Nearly half of the companies reported deteriorated payment experiences, due to financial difficulties of their customers

Payment experience in 2016 had deteriorated in comparison to the previous year for 46% of companies. For the majority of companies (79%), average overdues do not exceed 30 days. The same percentage of interviewees reported that the situation had remained stable in 2016, while 8% saw improvements.

Only 13% of companies reported having a ratio of over 5% on risk exposure (the ratio of total overdue to total sales). For almost 40%, this ratio is between 0.5% and 2% of total sales.

According to 57% of the respondents, the most frequent reason given by their customers when requesting payment extensions is ‘financial difficulties’, followed by ‘high delinquency rates in their client portfolios’ and ‘customer management problems’. In addition, 81% of companies cited the economic recession as being the principal macro fundamental impacting the creditworthiness of their customers.

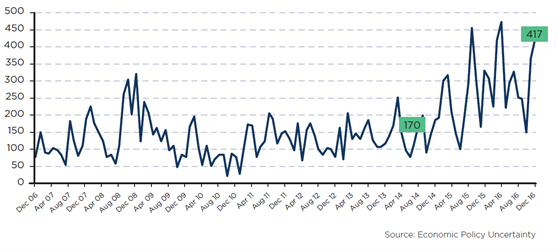

Political instability is also high - and unlikely to calm down in the short term. The EPU political uncertainty index corroborates this perception (see chart below – the higher, the worse). In the period from March 2014, the start of the car wash operation, until December 2016, the index gained around 247 points.

Brazil – EPU political uncertainty index

Most effective action in case of default

The vast majority (78%) of Brazilian companies believe that amicable negotiation is the most effective tool for resolving non-payments.

Even so, enforcing contracts in the country is not easy. According to the 2017 Doing Business Index, it takes 731 days on average and costs 20.7% of the value of a claim. As a comparison, the average for the Latin America as a whole is 749 days, at a cost of 31.3% of the claim.

In regards to insolvencies, the majority of surveyed companies (58%) saw the number of clients that filed for Chapter 11 soar in the last year. In 2015, a hike of 55% was reported compared to 2014. A further increase of 45% YoY was observed in 2016. Among those companies that reported an increase in Chapter 11 cases, 53% did not experience changes in customer behavior prior to the request. Over recent years, Chapter 11 has become more common in Brazil and is affecting companies of varying sizes and sectors.

Delays in payments across the sectors

Across the sectors analyzed, the average share of companies suffering from payment delays is 75%. Information & Communication Technologies, along with Construction, are the most affected, with 100% of companies reporting payment issues. Surprisingly, the least affected sector is retail with 36.8 %.

Average overdue days per sector are generally up to 30 days. The only segments that reported delays of over 121 days were Construction and Agri-food. Finally, it is also of interest to note that none of the cases in our sample exceeded 150 days.

Download the publication "Panorama: Coface Brazil Corporate Payment Survey"

- 75% of companies received payment extension requests

- Over 55% of companies saw increase in delinquency rates

- Hardest hit with delays were construction and agri-food sectors

Contact

Annie Lorenzana

COMMUNICATIONS MANAGER

North America

MOB: +1 (407) 221-3496

Annie.Lorenzana@coface.com