Strengths

- Technical progress contributing to cost reduction

- Highly concentrated maritime sector

- Long-term demand for main aircraft manufacturers driven by the need for mobility and the emergence of the middle classes in Asia

Weaknesses

- Sector highly dependent on fluctuations in oil prices

- Sector hit hard by environmental concerns (imposition of restrictive international legislation for manufacturers and users in the sector, e.g., CO2 emission standards)

- Sector highly dependent on climatic and biological hazards, exacerbated by the increasing frequency of extreme events (heatwaves, floods, fires, etc.).

- Sector closely linked to the economic cycle and world trade trends

Risk Analysis

Risk Assessment

The transport sector experienced a slowdown in 2023. Softening global trade on back of the downturn in global activity had a direct impact on all forms of transport, in particular sea freight (90% of trade) and air freight, which fell continuously between September 2022 and August 2023. Air passenger traffic, on the other hand, has continued to recover and is close to pre-pandemic levels (2.5% lower in December 2023).

The transport sector will not undergo any clear acceleration in 2024. Although the end of 2023 saw an improvement in certain year-on-year indicators, the global economic context is unlikely to allow strong growth in the sector. Global economic growth is expected to slow in 2024 (2.3% in 2024 after 2.6% in 2023 according to Coface forecasts), mainly due to an expected slowdown in China and the US.

High prices and interest rates are having an impact on household consumption and economic activity, particularly in the manufacturing sector. The Purchasing Managers Index (PMI), which reflects the economic state of a sector, shows a continuing decline in the manufacturing sector (value below 50). The slowdown in the manufacturing sector will have a negative impact on transport as a whole, both globally (sea and air) and regionally (rail and road).

The transport sector is facing other ongoing issues. While sea freight is being penalised by the normalisation of freight rates thanks to the easing of pressure on supply chains, road freight is facing a labour shortage (7% of jobs were vacant in 2023). The transport sector is also facing increasing geopolitical risk, as illustrated by the situation in the Red Sea. Over the longer term, the costs associated with environmental regulations will have a potentially negative impact on the transport sector.

Sector Economic Insights

The transport sector has been hit by the global economic slowdown

The manufacturing sector remains under pressure, affecting Europe in particular and is notably affected by rising energy prices, high interest rates and weak demand. Given the weak growth expected in 2024, household consumption is unlikely to accelerate and will consequently damp the sector's recovery. As a historical indicator of demand for air freight, the decline in the manufacturing sector may have a negative effect on air freight, which has been gradually recovering since the third quarter of 2023. Measured in tonne-kilometres (TKK), it was 2.3% above its pre-pandemic level in December 2023.

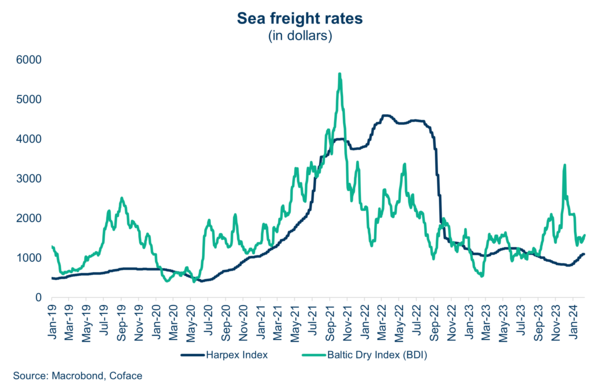

Maritime transport is particularly affected by the economic climate. In addition to the reduction in transport linked to weak demand, the sector is being penalised by the normalisation of freight rates, as evidenced by the Harpex Index (a measure of container rates), which fell by more than 80% between June 2022 and December 2023. The Baltic Dry Index (dry bulk rate), which is more volatile, has been rising very gradually since the second half of 2023. The easing of pressure on supply chains, present during the 2021 recovery, has led to a fall in freight rates (i.e., the cost of transporting goods), which has reduced the profitability of companies.

Recent events in the Red Sea have presented a new risk for the sector. Disruptions to maritime trade routes are forcing carriers to reorganise their itineraries, resulting in longer delays and possible commercial losses. Despite increases in freight rates that have more than doubled from Shanghai, and even tripled on certain routes to Europe, they are still, on average, below their record levels of early 2022. Although global trade is not experiencing any upheavals at the moment, instability in the Red Sea could disrupt supply chains. The Suez Canal is the fastest sea route linking Europe (notably Rotterdam and London) to Asia. Around 12% of global trade and 30% of world container traffic passes through it. The increase in freight rates is caused, on the one hand, by the rising cost of fuel and, on the other, by a reduction in the number of ships available. The number of ships available is falling because more ships must be used to maintain the same delivery schedule due to longer journey times. The reduction in the number of ships available adds to the increase in rates and costs while the increase in freight rates does not have a positive impact on the profitability of shipping companies.

On a more local scale, rail freight and road freight in the European Union are also being impacted by weak demand, resulting in negative year-on-year growth rates since the end of 2022, while growth remains positive for rail passenger transport. The road freight industry is also facing a labour shortage which is expected to double over the next five years according to the International Road Transport Union. The shortage can be explained by several factors, including a lack of attractiveness of the profession, high market entry costs (driving license, certifications) and demographic problems (ageing population of workers). This shortage could have a negative impact on the profitability of road freight companies.

Environmental concerns are shaking up the sector

Climate change has a direct (and indirect) impact on the transport sector, particularly maritime transport. Since mid-2023, the Panama Canal, a major crossing point linking the Pacific and Atlantic oceans (accounting for 5% of the world's maritime trade), has been suffering from severe drought and has forced the authorities to reduce the number of ships authorised to pass through it (24 per day in January 2024, compared with the usual 36). As with the Suez Canal, the reduction in traffic is leading to longer journey times and a risk of an increase in freight rates (albeit not observed at the start of 2024). In addition to droughts, climate change is causing other disruptions (floods, tropical storms, etc.), which are likely to damage maritime infrastructures.

To combat climate change, several measures have been taken to reduce the impact of the transport sector on the environment and health. These measures may have an impact on the whole transport sector as they impose new, more restrictive standards: reduced CO2 consumption and compensation for this consumption, etc. These regulations may mean higher costs for carriers, which will be forced to adapt their transport equipment. The additional cost could also be passed on to end consumers. However, new standards can encourage innovation and technical progress. This is the case with sustainable aviation fuels, which can reduce greenhouse gas emissions by up to 80% throughout their life cycle, compared with more conventional fuels such as paraffin. However, they currently account for just 0.1% of the sector's fuel consumption.

Among the most important regulations is the resolution of the International Civil Aviation Organization (ICAO) to implement a global mechanism for offsetting CO2 emissions from international aviation called "CORSIA" (Carbon Offsetting and Reduction Scheme for International Aviation). The first phase of the mechanism (from 2021 to 2026) is based on voluntary participation and had 125 member states in October 2023. The mechanism comprises several stages, including the purchase and cancellation by airlines of eligible emission units, corresponding to their final CO2 obligations offset during the compliance period. In July 2023, the International Maritime Organization (IMO) also adopted a strategy aimed at reducing greenhouse gas emissions from international shipping by at least 40% by 2030 (and neutrality by 2050). Measures to achieve this strategy are due to be adopted in the autumn of 2025: they will include a technical component (a marine fuel standard) and an economic component (a pricing mechanism).

Last update : June 2023